“The secondary market for standard retail assets (PTC & DA) has seen a robust growth of 56% in FY23 with total market volume exceeding ₹1.76 lakh crore. This growth reflects both the resilient performance of retail asset pools and the preference of banks to grow retail assets & meet priority sector lending (PSL) requirements. Bank lending to NBFC grew by 32% y-o-y and there is a positive correlation between interest rate and relative premium for PSL assets. Both these factors augur well for securitisation market. The market has seen one of the largest PSU banks testing the waters in the pass-through certificate (PTC) market. A few new good quality originators also accessed the market. We expect the market to continue to grow but at a moderate pace in FY24.”

- Vineet Jain, Senior Director at CARE Ratings

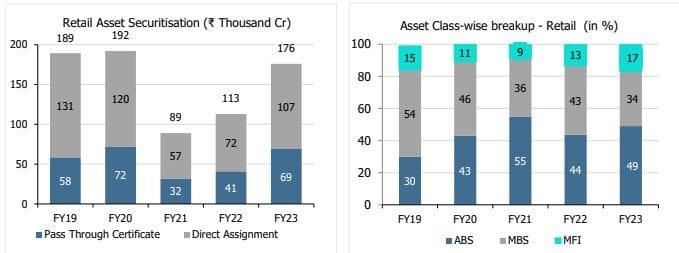

Strong Growth of the Securitisation Market The market registered a total volume (including direct assignment [DA] transactions) of around ₹176,000 crore (CARE Ratings estimate) – up from around ₹113,000 crore in FY22. DA transactions dominated the overall volumes constituting around 61% of the securitisation market with pass-through certificates (PTC) making up the remaining volume. The split between DA and PTC transactions has largely remained unchanged over the years. In addition to retail securitisation, the volume of wholesale securitisation transactions stood at around ₹6,600 crore

for FY23.

Minimal Disruptions Faced by the Securitisation Market

The retail securitisation market experienced significant growth in FY23, with minimal disruptions for the first time in three years. Unlike in previous years, the market was not heavily impacted by widespread disruptions caused by lockdowns and restricted movements of people and goods during the pandemic. The credit quality of retail assets remained resilient, and the total credit growth of banks increased by just over 15%, while bank credit to NBFCs grew by more than twice that rate. The two main drivers of growth for the securitisation market continue to be the Priority Sector Lending requirement and the need to expand the retail asset book.

The change in the regulations in December 2022 did not have any material impact on the overall volumes, except that securitisation volumes by Fintech lenders were negatively impacted in H2FY23, as predicted by CARE Ratings (‘Residual Maturity Norms May Hurt Fintech Lenders’).

The market has attracted new originators spread across universal banks, small finance banks, NBFC & HFC. This could have been driven by higher demand for retail assets and the interest rate scenario. The market saw a growth of around 30% in the number of originators.

The market also saw participation from one of the leading Public Sector Banks (PSBs) as investors in PTC transactions. This was a major change, given that their preferred mode of taking exposure used to be primarily through the DA route. This could have far-reaching implications for the PTC market. The market also saw instances of coupons (both PTC and DA) getting linked to floating rate benchmarks, even though the underlying loans in the transaction were fixed-rate loans.

Sanjay Agarwal, Senior Director at CARE Ratings, said, “Anchoring the investor coupon to floating rate benchmarks where the underlying pool comprises fixed rate contracts, increases complexity which needs to be factored in the evaluation of these transactions. The continued growth in volumes shows the confidence of the investors in securitisation as a product and the increased comfort that they have developed with the inherent complexity in the transactions.”

Retail Securitisation Volume and Asset Class-wise Breakup

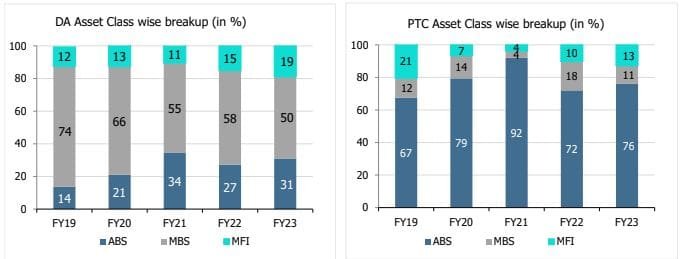

As mentioned earlier DA transactions dominated the market volume and mortgage-backed securitisation (MBS) transactions comprised a lion’s share of the DA volumes at 50%. Asset-backed securitisation (ABS) and microfinance [MFI] loan transactions constituted around 31% and 19% of the DA volumes, respectively. DA transactions witnessed a growth of around 49% in FY23 as compared to FY22.

PTC volumes were mainly driven by ABS pools contributing around 76% of the total PTC issuances, with around ₹42,500 crore (62% of PTC issuance) coming from vehicle loan financing, followed by MFI loans contributing around 13%.

Asset Class-wise Breakup of PTC and DA Volume

Outlook

The last fiscal witnessed a largely stable environment as compared to earlier years as the pandemic woes were left behind and the overall economic outlook was positive. Looking forward, even though a wider global economic slowdown is almost a certainty, the domestic growth story and its main hurdle in the form of high inflation would remain the main driving force for the retail securitisation market in FY24. Sriram Rajagopalan, Associate Director at CARE Ratings said, “The reduction in the volume expected from the culmination of the merger of the HDFC twins and the evolving situation with the growing adoption of the Co-Lending Model will have a major impact on the how the retail securitisation market evolves in the near future.”