My Finance Wellness – SIRI Micro Care today launched their loan product to help micro entrepreneurs in Chitradurga, Karnataka as part of their business expansion. Speaking on the occasion, the company Chief Executive Officer, Madhu Kiran emphasized the importance of “Responsible Lending” to under privileged entrepreneurs in the country.

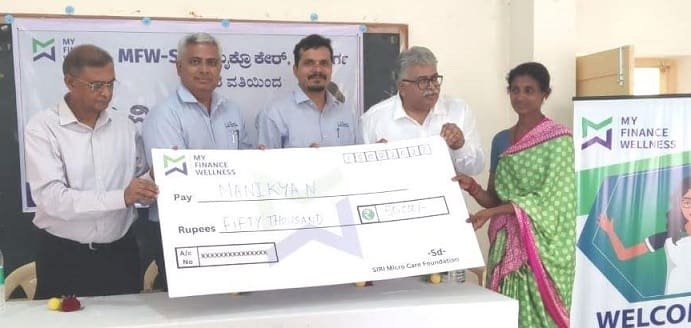

Left to Right – Sridhar DM, Madhu Kiran, Govind, Mohan and the beneficiary Manikya

Mr. Madhu Kiran, Chief Executive Officer, My Finance Wellness said, “The company’s offering enables entrepreneurs who are engaged in income-generating trade activities for earning their livelihood by providing end to end solutions of Financial Literacy, Micro Accounting Platform to track their business finance and Micro Loans.“

Talking about the just launched Micro Business Loans, which is offered to all first to credit, women, tiny, nano & unorganised entrepreneurs, the official said that these loans are provided even if there is no financial track record for customers who often get bypassed by traditional banks for want of documents. Company provides an in-house Made in India Micro Accounting Platform which enables these entrepreneurs to track their business progress and based on the platform usage they will be provided with the business loans.

Mr. Govind, Head of Strategic Partnerships for the company informed how company plans to work with more and more NGOs in the livelihood and women empowerment areas and make them Aatmanirbhar.

Mr. Sridhar, Managing Trustee of GRAMA, a NGO, who’s beneficiaries were given loan today, said such tie ups with new age MFIs will help NGOs like GRAMA who are dedicated to help micro entrepreneurs in rural and semi urban areas of the country.

About My Finance Wellness (MFW) – SIRI Micro Care

The company was formed in the year 2020, head quartered in Bangalore India, works with Tiny, Nano, Women entrepreneurs in tier 2, 3 & 4 areas by providing financial services by way Financial Literacy, Micro Accounting Platform and now starting off with Micro Business Loans. The company’s first in the country, model- B2H (Business 2 Humans) enables customers get digitally transformed with human touch by way of feet on street support. The company believes in solid business practices, transparent customer interactions and need based responsible lending to customers in order to ensure that each one of them is Financially Empowered to lead their business.

You can know more about the company and their business on www.myfinancewellness.com.