Marketing Budgets in Q3 2023 set to increase, but digital spends indicated to be lower

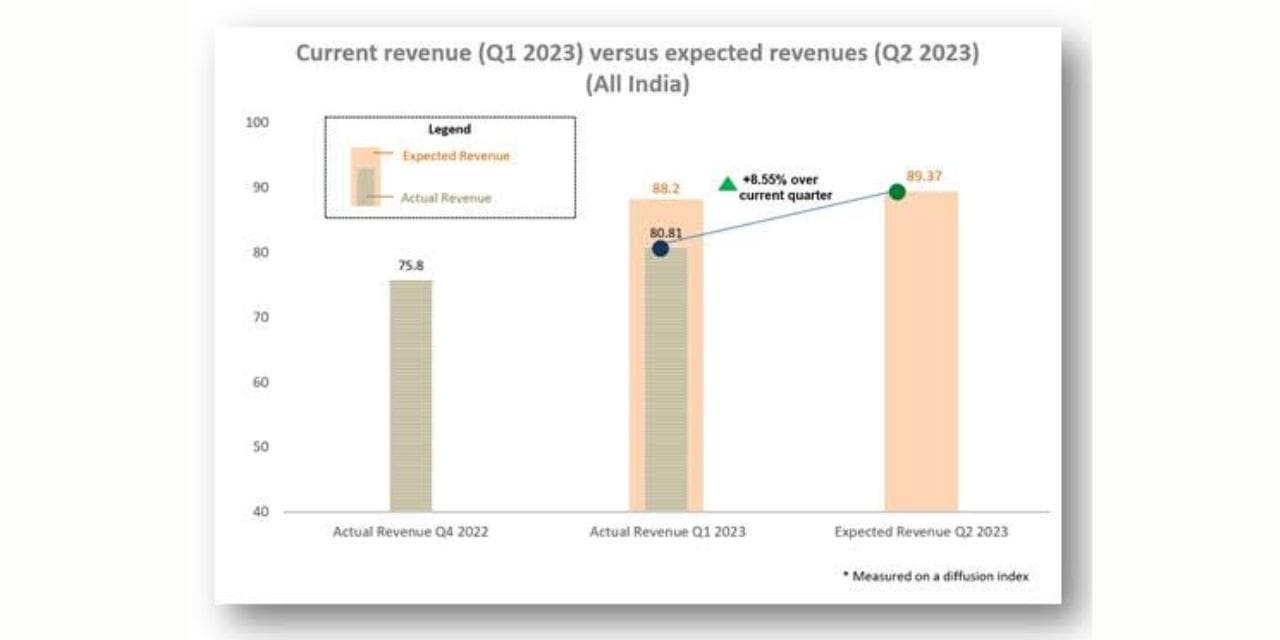

Hyderabad, 12th April 2023: TRA’s Marketing Decision Index (MDI) Q2 2023 is a quarterly benchmark report, the second in its series, and a global first that provides leading indicators through primary research conducted with 757 Marketing Decision Makers (MDMs) across 16 Indian cities between January and March 2023. In Q2 2023, India’s business optimism improves and remains significantly positive, with TRA’s MDI improving slightly to 89.37 in Q2 2023 from 88.2 in Q1 2023. Marketing budgets for the next quarter are set to increase considerably, from 80.5 in Q1 2023 to 85.1 in Q2 2023, a jump of 5.7%, reiterating the optimism in the quarter.

In Q2 2023, Radio Advertising showed the highest improvement (ranked 11th in Q1), with a strength of 68.60, followed by National TV (61.94) moving up three positions, Social Media (60.59) rising by one rank, and Digital Search (60.47) maintaining its fourth place. Digital Advertising dropped four ranks (60.09) to fifth place, Public Relations saw a significant decline in ranking (46.39) from Q1 to Q2, Local TV Advertising had a slight decline (44.67) to seventh place, and OOH witnessed a small decrease (40.08) to eighth place.

In comparing marketing medium strengths across four zones, Radio Advertising and Digital Advertising have shown higher levels of strength gains across all zones, while National TV Advertising has shown mixed results with higher strength in the West zone and lower strength in the South zone. Local TV Advertising has experienced lower levels of strength, particularly in the South zone. Fluctuations in strength have also been observed in Print Advertising, Out-of-Home (OOH), and Public Relations across different zones. The trends emphasize the need for companies to regularly modify their marketing approaches to maintain a competitive edge.

The report is meant to provide MDMs with timely, relevant, factual data to help in making applied marketing spend decisions using national, zonal, and city benchmarks.

About Marketing Decision Index

Please visit www.MarketingDecisionIndex.com for full report with detailed analysis data on Marketing Budget Allocations, Marketing Budgets, Media Spend Effectiveness & Media Budget Momentum and Revenue Optimism.

About TRA Research

Business Optimism improves, remains Significantly Positive: TRA’s Marketing Decision Index Q2 2023

Marketing Budgets in Q3 2023 set to increase, but digital spends indicated to be lower

Hyderabad, 12th April 2023: TRA’s Marketing Decision Index (MDI) Q2 2023 is a quarterly benchmark report, the second in its series, and a global first that provides leading indicators through primary research conducted with 757 Marketing Decision Makers (MDMs) across 16 Indian cities between January and March 2023. In Q2 2023, India’s business optimism improves and remains significantly positive, with TRA’s MDI improving slightly to 89.37 in Q2 2023 from 88.2 in Q1 2023. Marketing budgets for the next quarter are set to increase considerably, from 80.5 in Q1 2023 to 85.1 in Q2 2023, a jump of 5.7%, reiterating the optimism in the quarter.

In Q2 2023, Radio Advertising showed the highest improvement (ranked 11th in Q1), with a strength of 68.60, followed by National TV (61.94) moving up three positions, Social Media (60.59) rising by one rank, and Digital Search (60.47) maintaining its fourth place. Digital Advertising dropped four ranks (60.09) to fifth place, Public Relations saw a significant decline in ranking (46.39) from Q1 to Q2, Local TV Advertising had a slight decline (44.67) to seventh place, and OOH witnessed a small decrease (40.08) to eighth place.

In comparing marketing medium strengths across four zones, Radio Advertising and Digital Advertising have shown higher levels of strength gains across all zones, while National TV Advertising has shown mixed results with higher strength in the West zone and lower strength in the South zone. Local TV Advertising has experienced lower levels of strength, particularly in the South zone. Fluctuations in strength have also been observed in Print Advertising, Out-of-Home (OOH), and Public Relations across different zones. The trends emphasize the need for companies to regularly modify their marketing approaches to maintain a competitive edge.

The report is meant to provide MDMs with timely, relevant, factual data to help in making applied marketing spend decisions using national, zonal, and city benchmarks.

About Marketing Decision Index

Please visit www.MarketingDecisionIndex.com for full report with detailed analysis data on Marketing Budget Allocations, Marketing Budgets, Media Spend Effectiveness & Media Budget Momentum and Revenue Optimism.

About TRA Research